No one sets out to become an accountant just to spend their days copy-pasting invoice data, meticulously checking transactions, or manually updating ledgers. Accountants are trained to analyse financial performance, offer insights, and steer businesses toward growth. Yet, in many firms, a significant chunk of the day is still consumed by repetitive, low-value tasks. This is where Robotic Process Automation (RPA) steps in. RPA isn’t about robots taking jobs away. Instead, it’s about freeing accountants from the endless cycle of manual work so they can focus on what really matters: strategy, analysis, and decision-making.

The reality is, RPA has been gradually but surely transforming how accounting tasks are carried out. Many accountants might not even realise just how much of their daily workload could already be automated.

Let’s break down what RPA really is, how it applies to everyday accounting, and why it’s becoming an essential tool for forward-looking firms.

What Exactly Is RPA?

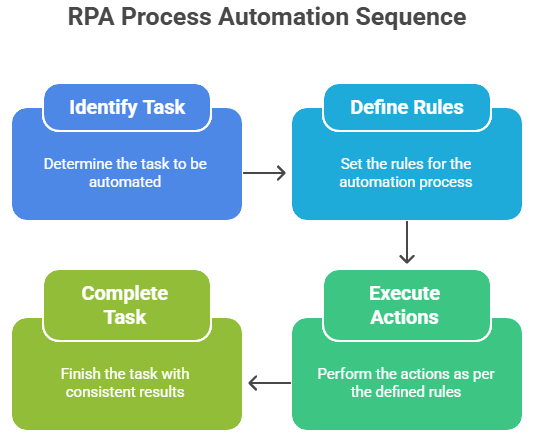

At its core, Robotic Process Automation is software that mimics human actions on a computer screen. Think of it as a virtual assistant that can:

Think of it as a virtual assistant that can:

- Click Buttons,

- Copy and paste data.

- Extract information from documents.

- Log into portals.

- Run calculations.

- Move data between systems.

All of this happens without human intervention, following a predefined set of rules.

Unlike artificial intelligence, RPA doesn’t “think” for itself. It follows structured, repetitive steps with perfect consistency. That makes it ideal for accounting tasks, which often involve structured data and standardised processes.

Now, let’s see how this translates into your everyday accounting life.

1. Invoice Processing: No More Manual Entry

Ask any accountant what drains their time, and invoice processing will likely make the list. Manually entering invoice headers, validating PO numbers, and ensuring details match across systems can eat up hours every week.

With RPA, the process becomes nearly touch-free:

- Bots extract invoice data from emails or PDFs.

- Validate the information against purchase orders.

- Post them into your ERP or accounting system (like Xero, QuickBooks, or Sage).

- Flag any discrepancies for human review.

The result? Invoices are processed in minutes instead of hours, errors are drastically reduced, and accounts payable teams can finally focus on vendor management instead of data entry.

Example: A mid-sized firm that receives 500+ invoices a month could save dozens of work hours each week simply by automating data extraction and entry.

2. Account Reconciliation Without Late Nights

Reconciliation is essential but painfully repetitive. For firms handling hundreds—or even thousands—of transactions each week, manually matching them against ledgers can feel endless.

RPA transforms reconciliation by:

- Automatically matching transactions with ledger entries

- Flagging mismatches for review

- Generating reconciliation reports instantly

This doesn’t remove human oversight — accountants still verify flagged items. But instead of spending hours slogging through every entry, they only need to focus on exceptions.

Result: Faster closings, fewer errors, and accountants with energy left for higher-value analysis.

3. Data Migration Between Systems

Switching to a new accounting platform is often dreaded because of the massive data transfer required. Copying, cleaning, and uploading data manually is not only tedious but also prone to error.

RPA makes this process seamless:

- Extracts structured data from legacy systems

- Reformats it to suit the new platform

- Uploads it consistently and accurately

This approach isn’t just efficient—it’s audit-proof. Every step is logged and traceable, ensuring compliance and transparency.

Use Case: When a firm upgrades to a new ERP system, RPA bots can handle weeks of manual migration work in just a few days.

4. Expense Management on Autopilot

Submitting, verifying, and reimbursing employee expenses can be a headache. Employees forget receipts, managers delay approvals, and finance teams end up with mismatched records.

With RPA:

- Bots extract details from digital receipts or scanned copies.

- Validate expenses against company policy.

- Route them automatically for manager approval.

- Process reimbursements in bulk once approved.

This reduces bottlenecks and ensures policy compliance without finance teams chasing employees for paperwork.

5. Payroll Accuracy, Every Time

Payroll processing is highly rule-based and repetitive — which makes it perfect for RPA. Bots can:

- Pull employee timesheet data.

- Calculate wages and deductions.

- Update payroll systems.

- Generate payslips and reports.

This ensures every employee is paid on time and accurately, reducing compliance risks and boosting employee satisfaction.

6. Compliance and Reporting

Staying compliant with tax laws, audit requirements, and financial regulations involves huge amounts of data compilation and reporting.

RPA helps by:

- Pulling financial data from multiple systems

- Consolidating it into standard report formats

- Running checks for compliance rules

- Maintaining an audit trail of every automated action

Instead of scrambling during audits, accountants can produce accurate, ready-to-submit reports in minutes.

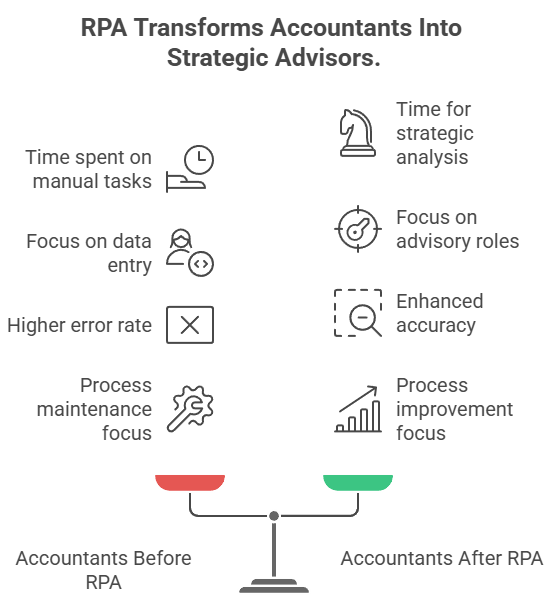

Why RPA Doesn't Replace Accountants

A common misconception is that automation replaces people. In reality, RPA augments accountants by taking over the grunt work.

Here’s what accountants gain:

- Time for analysis: Instead of entering invoices, they can interpret data and identify trends.

- Focus on strategy: Advising management or clients on decision-making becomes a priority.

- Enhanced accuracy: With fewer manual entries, errors drop significantly.

- Process improvement: Accountants can spend time strengthening internal controls instead of chasing mismatched numbers.

In short, RPA lets accountants become more like advisors and less like data clerks.

The Business Impact of RPA in Accounting

Firms that embrace RPA see tangible benefits:

- Speed: Processes that took days can be completed in hours.

- Accuracy: Error rates drop dramatically.

- Cost savings: Reduced manual hours mean lower operational costs.

- Scalability: Bots handle high transaction volumes without needing extra staff.

- Employee satisfaction: Teams are less burdened by monotonous work, leading to higher retention.

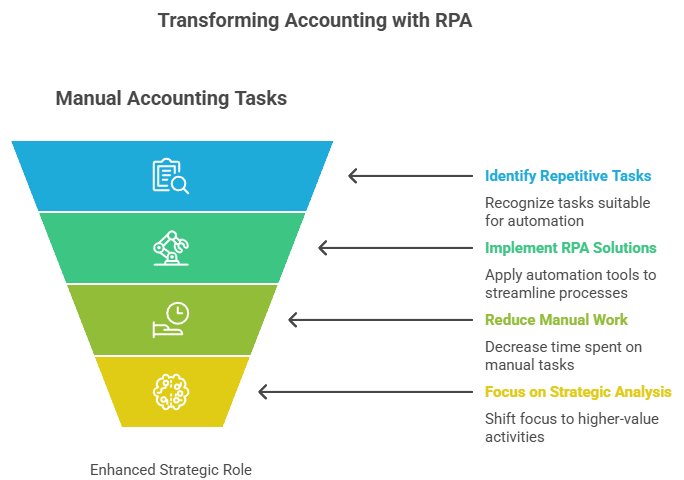

Implementing RPA: Where to Start

If you're considering RPA for your accounting team, here's a roadmap to begin:

- Identify repetitive tasks – Look for processes that are rule-based and high-volume.

- Start small – Begin with a single process like invoice processing or reconciliations.

- Measure impact – Track time saved, error reduction, and cost efficiency.

- Scale gradually – Expand automation to other areas like payroll or compliance.

- Integrate with existing systems – Choose RPA tools that work with your current accounting software.

At Virtual Clone, we specialise in helping accounting firms identify RPA-friendly processes and implement automation solutions tailored to their workflows. The goal is simple: automation should adapt to your business, not the other way around.

The Future of Accounting with RPA

As accounting evolves, the role of accountants is shifting from number-crunching to business advising. RPA is one of the catalysts accelerating this change.

Imagine a future where:

- Month-end closings happen in hours, not days.

- Reports are ready instantly for decision-making.

- Compliance is continuously monitored, not checked retroactively.

- Accountants spend their days adding value, not entering data.

That future isn't decades away — it's already here for firms embracing RPA today.

Final Thoughts

If you’re still buried under spreadsheets, the question isn’t if RPA can help, but when you’ll adopt it. The firms that act early will not only save time and costs but also position themselves as strategic advisors to clients.

So, the next time you find yourself repeating a task and thinking, “There must be a better way,” there probably is. And chances are, a robot can handle it.

At Virtual Clone, we’re here to help you explore the possibilities of automation. Let the machine take care of the repetition while you focus on strategy and insights.